The Maturity Report with Gap Analysis (SWOT)

The Maturity Report with Gap Analysis (SWOT) is a deliverable of the Digital Services in the Circular Economy (DECIDE), regarding the positioning of the project itself within the complex environment of the Circular Economy to contribute to a better design of the business modelling.

The report focuses on conducting thorough research to identify the specific challenges and opportunities that exist in the target areas with respect to circular economies and derive requirements for the analysis and development of circular economies and respective business models using innovative digital tools. Based on available public data and direct survey – structured interviews conducted by the project partners during the Period 1 (1-6 months) of the implementation, we propose both a comprehensive outlook and a specific perspective by highlighting country profiles regarding the generous topic of the Circular Economy, as a pillar of the sustainable development.

The literature review allows us to emphasize some Circular Economy Key characteristics:

- Design for Longevity and Recycling;

- Material Recovery and Recycling;

- Waste Reduction;

- Use of Renewable Energy;

- Circular Business Models;

- Industrial Symbiosis;

- Service Economy;

- Closed-Loop and Cyclicality;

- Innovation and Technology;

- Reduced Environmental Impact.

Circular Economy specific indicators

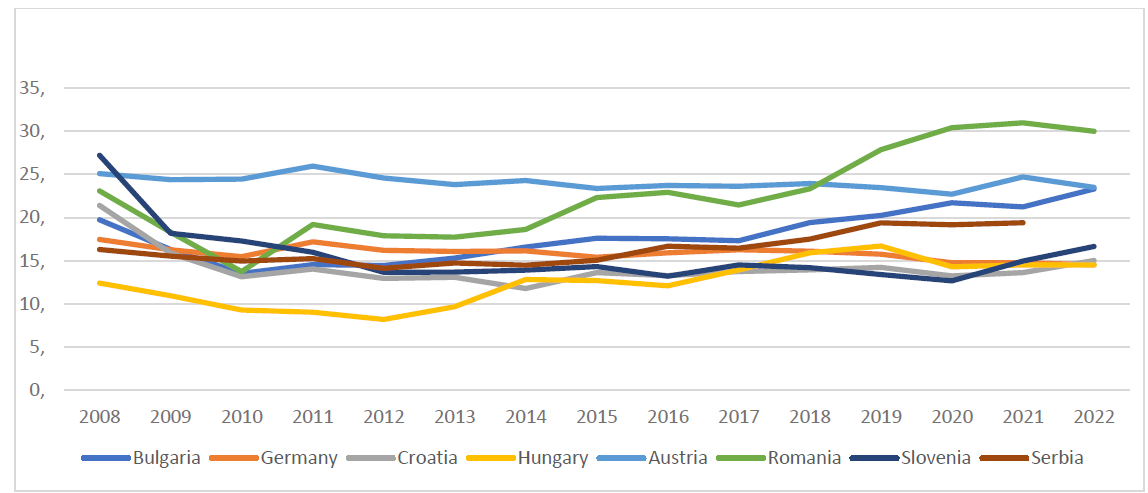

The material footprint is one of the main indicators that must be addressed if we want to implement a Circular Economy Business Model – CEBM. The indicator quantifies the worldwide demand for material extractions (biomass, metal ores, non-metallic minerals and fossil energy materials/carriers) triggered by households, governments and businesses’ consumption and investment in the EU.

Analyzing the evolution of the material footprint (Figure 1) in 2008-2022, the following are highlighted: Romania and Austria recorded the highest values, presenting an upward trend in terms of materials extracted to satisfy consumer demand. On the other hand, from 2008 until 2016, Hungary had the most favorable situation. Starting with 2017, there was a slight increase, but Hungary continues to remain among the countries with the fewest extractions, along with Croatia and Germany.

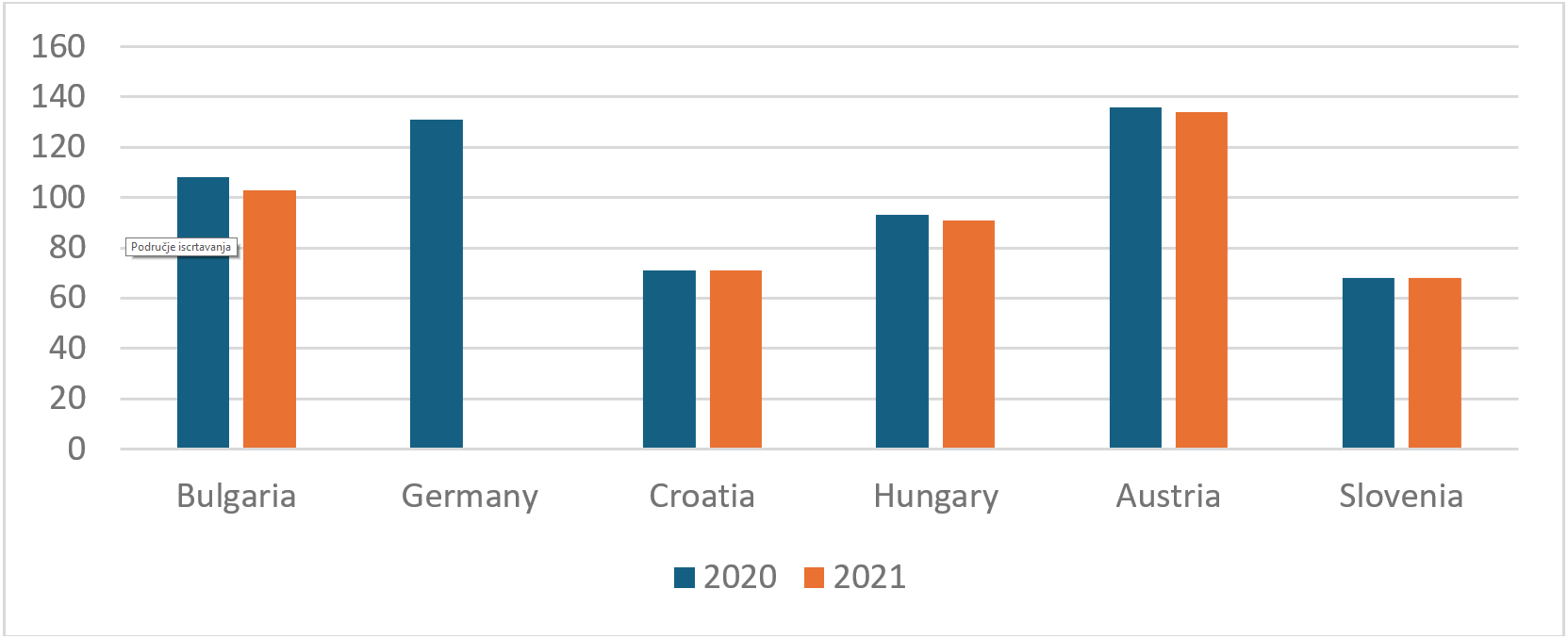

Food waste indicator is defined as the amount of food waste generated per year divided by the average population of the country. Food waste is measured as fresh mass all along the food value chain, including production sites, processing and manufacture, retail and distribution, restaurants and food services and households.

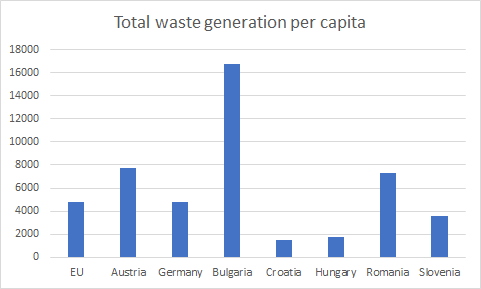

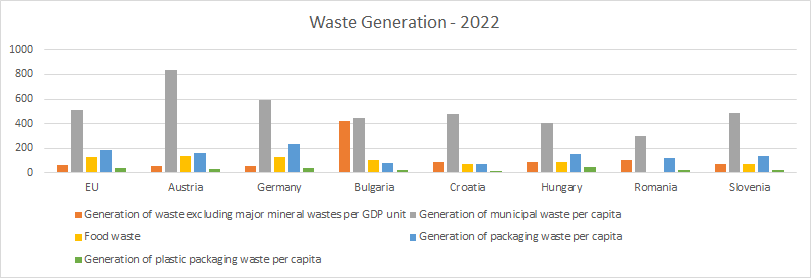

- Generation of waste excluding major mineral waste: Bulgaria;

- Food waste: Austria;

- Generation of plastic packaging waste per capita: Hungary;

- Generation of municipal waste per capita: Austria;

- Generation of packaging waste per capita: Germany.

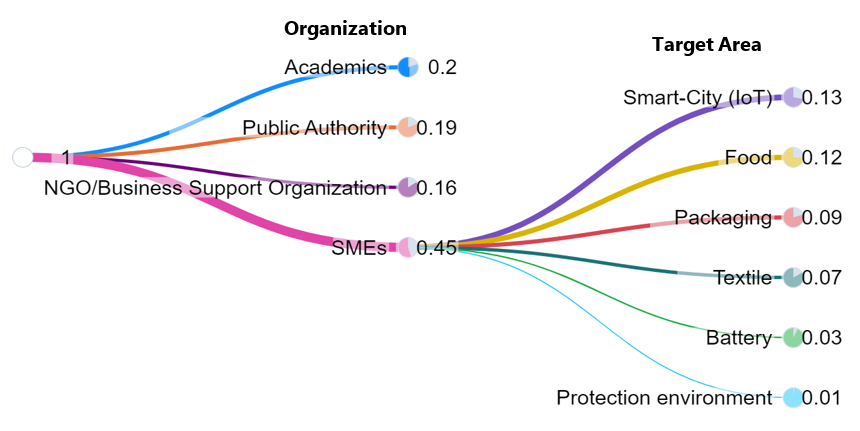

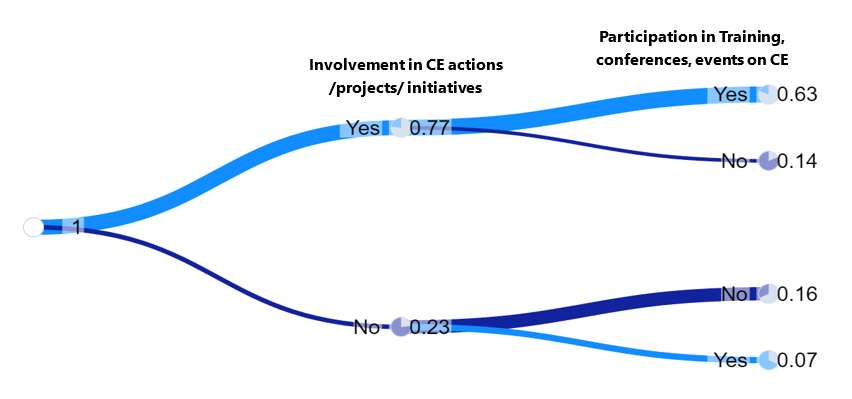

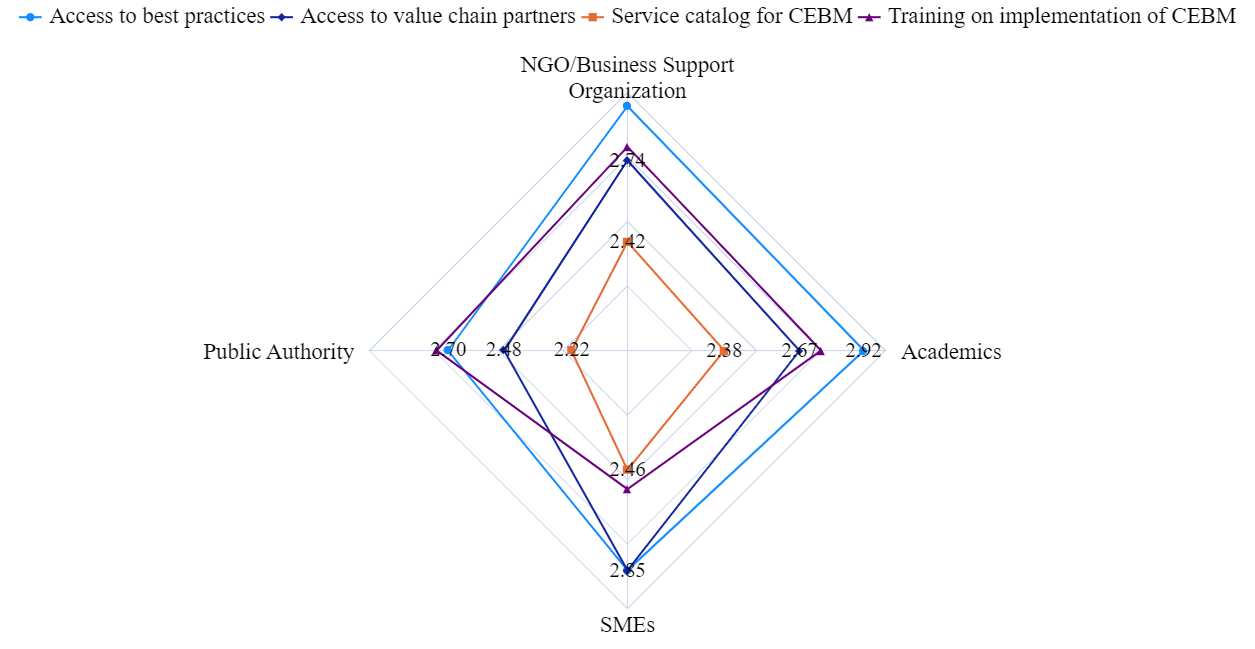

To achieve an overview of the Circular Economy in the Danube Region, project partners conducted an interview with the target group (125 respondents) to identify the challenges and opportunities of the state of Circular Economy Business Models on the following sectors: food, battery, textile, packaging, and smart city. The results of the interviews in the project partners countries were used to find the most important challenges and opportunities of the quadruple helix representatives and to highlight the most appropriate activities to be carried out.

Circular Economy’ challenges and opportunities in the Danube Region

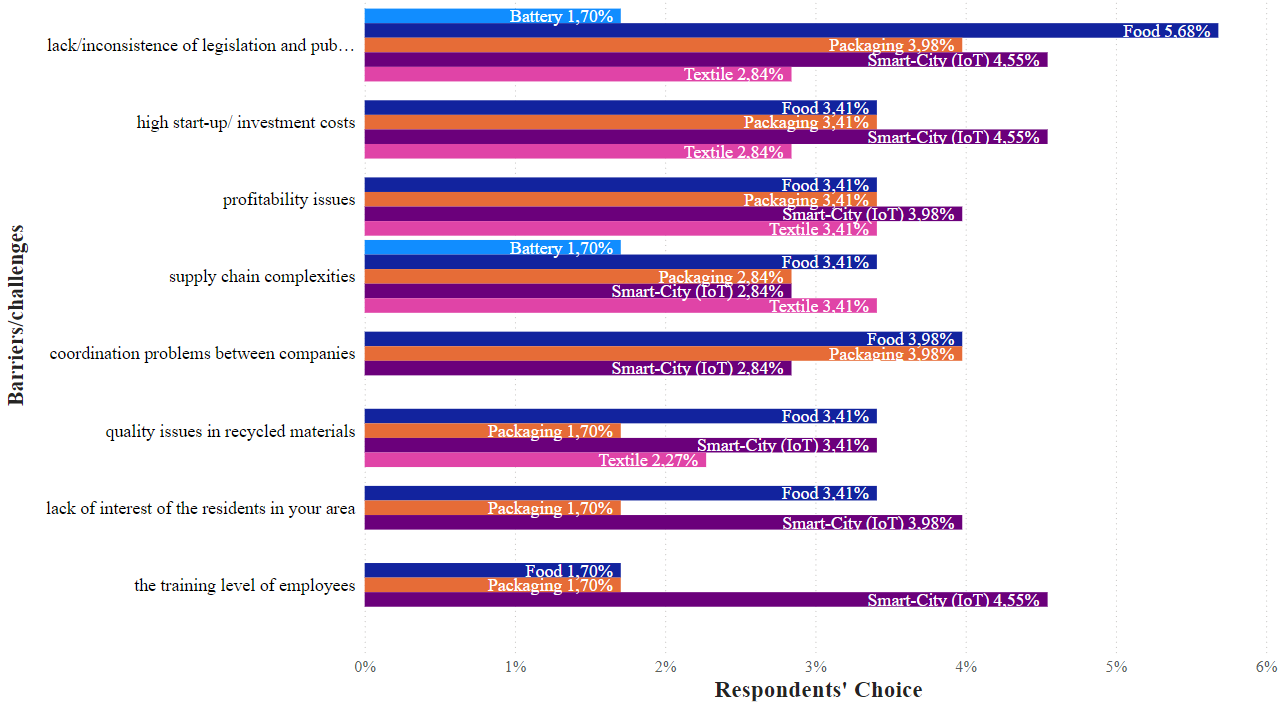

- SMEs from food industry rated as one of the most critical challenges lack/inconsistence of legislation and public strategy, coordination problems between companies, high start-up/ investment costs, profitability issues and supply chain complexities.

- SMEs/Organizations from Smart City (IoT) industry rated as the most important challenges the following: lack/inconsistence of legislation and public strategy, high start-up/ investment costs, and the training level of employees. Battery: lack/inconsistence of legislation and public strategy and supply chain complexities.

- Packaging: coordination problems between companies, lack/inconsistence of legislation and public strategy, high start-up/ investment costs and profitability issues.

- Textile: profitability issues, supply chain complexities, high start-up/ investment costs and lack/inconsistence of legislation and public strategy.

In conclusion, respondents highlighted that there are notable concerns about coordination between companies and quality issues in recycled materials. Also, the training level of employees appears to be a significant challenge across these sectors. But the most scored challenges remain the lack/inconsistence of legislation and public strategy, high start-up/ investment costs and supply chain complexities. These insights will help us to highlight the complexity and multifaceted nature of implementing circular economy principles in different industries.

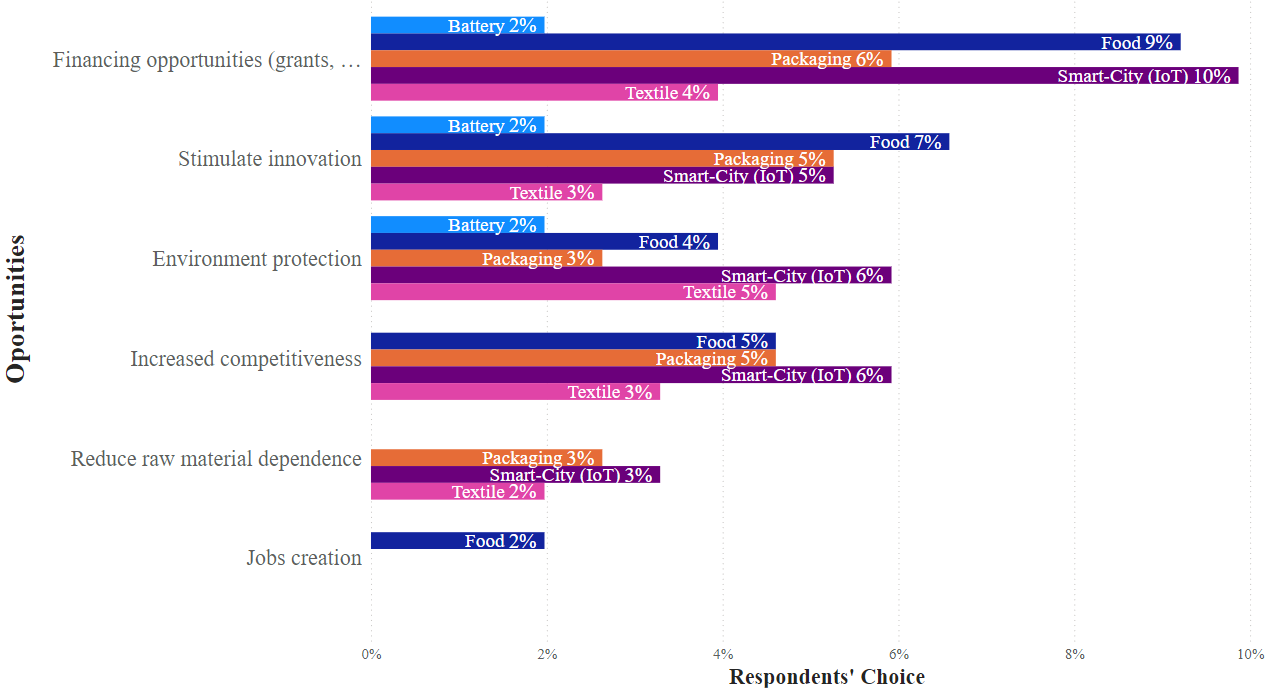

- Food: financing opportunities, stimulate innovation, increase competitiveness and environmental protection.

- For packaging and Smart City is the same option and the same order: financing opportunities, stimulate innovation, increase competitiveness, environmental protection and reduce raw materials dependencies.

- In the textile industry the most attractive opportunity is environmental protection followed by financing opportunities, increased competitiveness, stimulate innovation and raw materials dependencies.

- In the case of Battery industry, the most attractive opportunities are: environment protection, financing opportunities and stimulate innovation.

These insights suggest that financial incentives, innovation, and environmental concerns are primary drivers for SMEs to participate more actively in the circular economy.

Industry driven Overview

The results of the use of an adapted SWOT analyses provide us insights into strengths, weaknesses, opportunities, and threats faced by each industry sector within the Circular Economy initiatives in the Danube countries.

Food Industry

- Strengths: High potential for added value in the food industry through Circular Economy models, rated highly across all organizations type as we saw in the figure 28.

- Weaknesses: those who run a business in the food industry must overcome challenges such as coordination problems, high start-up costs, and supply chain complexities which take a big effort to be successfully solved.

- Opportunities: food industry representatives rated financing opportunities, innovation stimulation, and environmental protection as key opportunities.

- Threats that will be similar also to other industries are: lack of consistent legislation, profitability issues, and the training level of employees identified as major challenges.

Battery Industry

- Strengths: Identified potential for added value, especially by SMEs, despite some differences in the scoring.

- Weaknesses: Rated with the lowest overall score in added value, indicating gaps in understanding within the public sector of the role and impact of the battery industry.

- Opportunities: Environment protection is one of the main factors that could inspire the battery industry to implement CEBM, also financing opportunities in most of the countries are crucial but in they exist and must be promoted, and innovation stimulation is also an important factor in this industry.

- Threats: Lack of consistent legislation, supply chain complexities, and high start-up costs that can limit the social and economic impact of CEBM in battery industry.

Textile Industry

- Strengths: Considerable opportunity for added value in the textile industry through recycling and sustainable production methods.

- Weaknesses: Profitability issues, lack of impact of initiatives by textile industry representatives, and necessity of a complex supply chain even if it is not a perishable material.

- Opportunities: Environmental protection trends an important to encourage textile CEBM, financing opportunities, and increased competitiveness are primary opportunities.

- Threats: Challenges related to profitability, and we would like to highlight also the lack of residents in the area of textile CEBM, that’s why the supply chain complexities are also an influencing factor.

Packaging Industry

- Strengths: Identified as having high potential for added value by SMEs and in academia. Also, from country profile and interview results we can say that packaging, in some cases, have already the specific environment to implement CEBM, especially around recycling activities.

- Weaknesses: Challenges such as coordination problems, lack of consistent legislation, and high start-up costs prevalent.

- Opportunities: Financing opportunities, stimulation of innovation, and increasing competitiveness are voted as main opportunities in packaging industry.

- Threats: Coordination challenges, legislative inconsistencies, and high initial investments pose threats.

Smart City (IoT)

- Strengths: Integration of IoT enhancing circular economy practices identified as having moderate to high potential for added value.

- Weaknesses: Challenges related to legislative contradictions, high start-up costs for CEBM, and employee training recognized as a weakness in this industry.

- Opportunities: Financing opportunities, innovation stimulation, and environment protection are key opportunities. Also, as we noticed from the interviews, the need for integration of IoT in the CEBM cross-industry can be included also in the opportunity section.

- Threats: Lack of consistent legislation, high costs, and underdeveloped training services for employees.

By addressing these factors, accordingly, DECIDE project partnership will bring a series of tools, trainings and recommendations for each industry that can further improve its sustainability practices and enhance its contributions to the circular economy principles.

Conclusions

The DECIDE project partners identified a series of gaps related to implementation of CEBM in the Danube Region that will be promoted to different regional developers. This will ensure an understanding of the main problems and limitations and will be a significant support for policy development in the Danube Region. As a response to a part of gaps identified above, DECIDE project members will adapt the solutions for target groups organizations interested in the project activity.

At the end of the first implementation period, we can argue that there is a gap between industries and countries analyzed in this report, but with the potential of the DECIDE project and many others in the European Union, those gaps can be covered in the following ways:

The business sector should consider wider implementation of business processes connected to Circular Economy. Moreover, SMEs must ensure the involvement of stakeholders and track the supply chain through all actors involved.

Innovation and digitalization in the field of Circular Economy will contribute to a better understanding and adoption of the CEBM in the target areas and Danube Regions. The DECIDE project will contribute to this process with the Toolbox of digital solutions on CEBM.

Regional developers must get involved in much more initiatives and actions related to Circular Economy. Also, the findings of the present report could be used by regional developers in future policy development and smart specialization strategies related to Circular Economy business model implementation: diversifying financing and investment programs; ensuring access to knowledge and training, adapting legislation and public strategy; reducing complexities in the supply chain management; influencing the market demand and the consumer behavior.

DECIDE project members will be involved in this kind of activities in the following years and will be ready to provide some insight, expertise and access to knowledge and best practices.

Back to homepage

News & Events

Read the most recent updates and explore the upcoming events.